The Evolution of Credit Cards : What started the credit card revolution? It changed how we buy things and handle money. The story of credit cards is rich and spans many years, from the Diners Club to today’s digital payments. We’ll look at the important moments and new ideas that have made the industry what it is now.

Introduction to Credit Card History

The journey of credit cards has seen big tech leaps and shifts in what people want. Knowing the history of credit cards helps us see their big role in world trade. As we dive into this, we’ll see the big names, new tech, and hurdles that have helped the industry grow.

Key Takeaways

- The credit card evolution began with the introduction of the Diners Club in the 1950s.

- The credit card industry has undergone significant transformations in response to technological advancements and changing consumer needs.

- Understanding the untold history of credit cards is crucial to appreciating the impact of credit cards on global commerce.

- The credit card evolution has been marked by the introduction of new technologies, such as magnetic stripes and EMV chip technology.

- The rise of digital payments has further transformed the credit card industry, with the introduction of mobile wallets and contactless payments.

- The credit card evolution has been shaped by major players, including banks and financial institutions.

The Birth of Modern Credit: The Diners Club Story

Frank McNamara, the founder of the Diners Club, forgot his wallet at a New York restaurant. This led to the idea of a card for multiple merchants. The Diners Club, launched in 1950, is seen as the first modern credit card.

The Diners Club faced early challenges but offered credit card industry insights. It started with 27 merchants in New York but grew to other cities and countries. Its success came from making purchases easy and secure, without cash.

Some key features of the Diners Club include:

- Universal acceptance: The Diners Club was accepted by multiple merchants, making it a convenient option for travelers and shoppers.

- Revolutionary concept: The Diners Club introduced the concept of a credit card that could be used at multiple locations, paving the way for the development of modern credit cards.

- Growth challenges: The Diners Club faced several challenges in its early years, including limited acceptance and high fees, but it continued to grow and expand its services.

The Diners Club was crucial in shaping the credit card industry. It provided insights and lessons for modern credit cards. Today, millions worldwide use credit cards for purchases and finance management.

How Early Credit Card Processing Worked

Credit card technology has evolved a lot since it started. Back then, processing credit card payments was a slow and hard task. Merchants had to call the credit card company to check if the card was good and if the transaction was okay. This was slow and often had mistakes.

Merchants and credit card companies faced big challenges back then. These included:

- Checking if the cardholder’s information was correct

- Getting approval for each transaction

- Doing everything by hand

These problems showed the need for better credit card technology. This was to make transactions faster and safer.

As the credit card world grew, so did the tech for handling payments. New tech like magnetic stripes and electronic systems made things easier and less error-prone. Today, keeping up with new tech is key for credit card payments.

The growth of credit cards has been driven by new tech and ideas. From the old days of manual work to today’s digital payments, tech has been crucial. It has changed how we do transactions.

The evolution of credit cards has transformed the way we shop, travel, and manage finances. From the first Diners Club card to today’s digital payments, innovation has shaped the industry. For an in-depth look at how Visa played a pivotal role in this journey, explore Visa’s history here.

The Rise of Bank-Issued Credit Cards

The introduction of bank-issued credit cards was a big change in the credit card innovation timeline. It changed how people paid for things. This was a key part of the evolution of payment methods, making credit cards more common than the first Diners Club card.

Bank of America’s BankAmericard, launched in 1958, was the first bank-issued credit card to succeed. It showed other banks how it could be done.

As the evolution of payment methods kept going, Visa and MasterCard networks made credit cards even more widespread. Soon, regional banks started their own credit cards and joined the networks. This led to more competition and new ideas in the industry, pushing the credit card innovation timeline ahead.

Some important reasons for the rise of bank-issued credit cards include:

- Increased accessibility: Bank-issued credit cards made it easier for people to get credit. They weren’t just for one store or merchant anymore.

- Improved convenience: Credit cards made buying things faster and easier, without needing cash.

- Enhanced security: New features like magnetic stripes and later EMV chips helped lower fraud. This made people more confident in using credit cards.

The rise of bank-issued credit cards was a big step in the evolution of payment methods. It set the stage for today’s credit card industry. As the credit card innovation timeline keeps moving, it will be exciting to see how the industry meets new tech and changing needs.

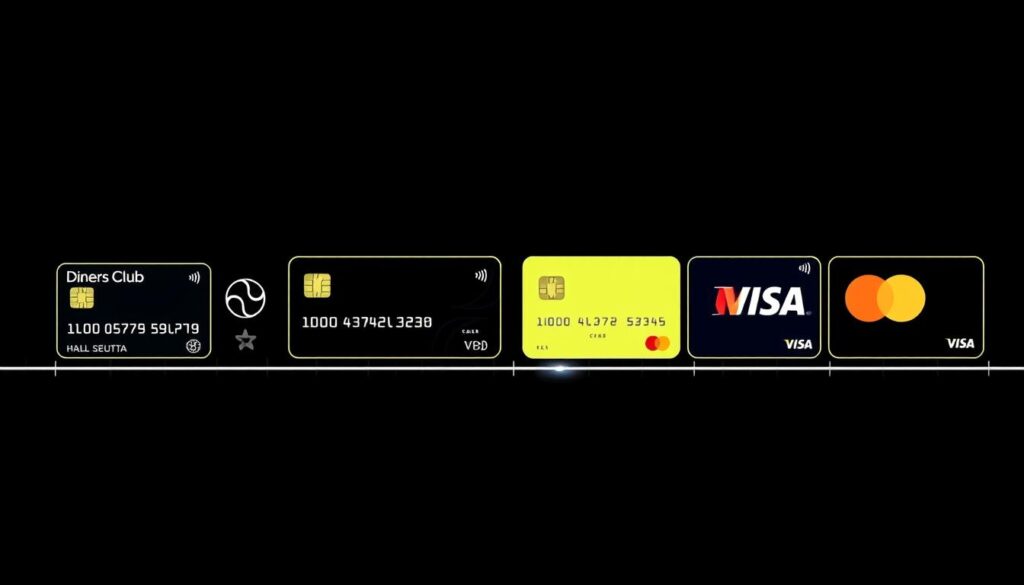

The Untold History of Credit Cards: How They Evolved From Diners Club to Digital

The credit card historical evolution has seen major changes. It started with the Diners Club and has moved to today’s digital payment advancement. These changes have made buying things easier, safer, and more accessible.

Some important moments in the credit card historical evolution are:

- The launch of BankAmericard, which later became Visa

- The introduction of MasterCard, which made credit cards available worldwide

- The development of digital payment advancement, including online and mobile payments

Now, credit cards are a big part of our daily shopping. The credit card historical evolution has been influenced by new tech, changing what people want, and the growth of digital payment advancement. It’s exciting to think about how credit cards will change with new tech and what people need.

The future of credit cards will likely be shaped by digital payment advancement. This includes mobile wallets, contactless payments, and using your face or fingerprint to pay. As the industry keeps getting better, knowing the credit card historical evolution is key to understanding today’s digital payments.

Technological Breakthroughs in Credit Card Security

The credit card industry has seen big changes in security. These changes have changed how we do transactions and keep them safe. Credit card technology development has grown thanks to new ideas like magnetic stripes and EMV chip technology. These have made credit card use safer, cutting down on fraud and identity theft.

Looking at the credit card innovation timeline, we see a lot of progress. Some major steps include:

- Introduction of magnetic stripes, which store cardholder data and make transactions easier

- EMV chip technology, adding more security with encryption and tokenization

- Modern security features, like biometric authentication and real-time fraud detection

These updates have made transactions safer and improved how we use credit cards. With ongoing credit card technology development, we’ll see even more new ways to pay.

In summary, the credit card world has made big leaps in security and fighting fraud. Thanks to the credit card innovation timeline, we’re seeing safer and easier ways to pay. As tech keeps getting better, we’ll see even more changes in the credit card industry.

The Digital Revolution in Credit Card Payments

The way we make payments has changed a lot, thanks to credit cards. Online shopping, mobile payments, and contactless transactions have become popular. This has made credit card companies change how they work.

People now want to pay quickly and easily. They don’t like carrying cash or waiting in line. So, credit card companies have introduced contactless payments and mobile wallets.

Some important features of this digital change include:

- Online payment platforms

- Mobile payment apps

- Contactless payment technology

- Tokenization and encryption for secure transactions

These changes have made paying easier and safer. As payment methods keep evolving, it’s important to keep up with new ideas.

Credit cards have come a long way since they first appeared. Looking ahead, it’s exciting to see what the future of credit card payments will bring.

Mobile Wallets and Contactless Payments: The New Frontier

Digital payments have changed how we buy things, and mobile wallets are key to this change. Looking into the history of credit cards shows a big move to contactless payments. Now, thanks to NFC technology, making payments is as simple as tapping your phone.

Storing your credit card info safely on your phone makes things even better. Apple Pay, Google Pay, and Samsung Pay are examples of digital wallets that make paying easier. As digital payments grow, we’ll see even more new ways to pay.

Biometric tech like facial scans and fingerprints adds security to mobile wallets. These features help keep your transactions safe and approved. As we move forward with mobile wallets and contactless payments, understanding credit card history is crucial.

- NFC technology enables fast and secure transactions

- Digital wallet integration simplifies the payment process

- Biometric authentication methods enhance security and convenience

In conclusion, mobile wallets and contactless payments are big steps in digital payments. As we learn more about credit card history, it’s clear these techs will shape our future payments.

The Impact of Credit Cards on Global Commerce

The credit card evolution has changed global commerce a lot. It makes buying things easy across borders and helps with international trade. Now, people can buy things from anywhere, and businesses can reach more customers worldwide.

Some key benefits of credit cards in global commerce include:

- Convenience: Credit cards make buying things online or in-store easy and safe. This lets consumers shop from anywhere.

- Increased sales: Businesses get more sales and money when they accept credit cards. This is because people like to buy when it’s easy to pay.

- Improved cash flow: Credit cards help businesses manage their money better. Payments are quick and easy.

According to credit card industry insights, more people are using credit cards. They prefer digital payments for their ease and safety. As credit cards keep evolving, we’ll see new ways to pay that will change how we shop globally.

In conclusion, credit cards have greatly impacted global commerce. Their use will keep growing. It’s important for businesses and consumers to keep up with the latest credit card industry insights and trends. This way, they can enjoy the benefits of credit cards.

Conclusion: The Future of Credit Card Technology and Digital Payments

The credit card industry has seen a lot of changes since the Diners Club card was introduced. Bank-issued cards became popular, and now we have digital payments. The industry keeps adapting to what people need and new technology.

We’re looking forward to more changes in credit card tech and digital payments. New tech like blockchain and AI will help make payments safer and easier. They will change how we do transactions and how we feel about using credit cards.

Biometric tech like fingerprints and facial scans is becoming more common. It makes using credit cards safer and more convenient. Also, using credit cards with mobile wallets and contactless payments will become the standard. This will make paying for things easy and secure.

The credit card world will keep growing and changing. It’s important for leaders to keep up with what people want and need. By focusing on new ideas and keeping payments safe, the industry will stay important and trusted worldwide.

The Evolution of Credit Cards : FAQ

What was the origin of the first modern credit card?

The Diners Club, launched in 1950, is often seen as the first modern credit card. It was created after Frank McNamara forgot his wallet. This led to the idea of a universal card for use at many merchants.

How did early credit card processing work?

Early credit card processing was manual and slow. Merchants had to call the credit card company to check the cardholder’s info. This was time-consuming and often led to mistakes.

What was the impact of bank-issued credit cards on the industry?

Bank-issued credit cards changed the industry a lot. Bank of America’s BankAmericard, launched in 1958, was the first big success. Visa and MasterCard networks later grew the use of credit cards even more.

What were the key technological breakthroughs in credit card security?

The credit card industry has seen big advances in security. Magnetic stripes, EMV chip technology, and new security features have made transactions safer.

How has the digital revolution transformed credit card payments?

The digital revolution has changed how we use credit cards. Online shopping, mobile payments, and contactless transactions have grown. This has led to new ways like mobile wallets and biometric authentication.

What is the impact of credit cards on global commerce?

Credit cards have greatly affected global commerce. They let people make transactions across borders and help international trade. They make it easier for both consumers and businesses to manage money worldwide.